Sedalia Council Passes Resolution for County-Wide Road Tax Allocation

The City of Sedalia issued a very lengthy press release Thursday afternoon regarding an ongoing feud with Pettis County, pertaining to the transfer of tax funds, as well as other issues:

In regard to the passage of a resolution at the February 21 Council Meeting, the public should be aware of the background surrounding the changes the Pettis County Commissioners have announced regarding allocations to Cities of the half-percent Road and Bridge county-wide sales taxes.

This specific issue came to fruition when Mayor Dawson, learning of the possible demolition of the “Equitable Building,” had a conversation with the Commissioners requesting that they comply with the City’s building safety codes. During this discussion the Commissioners indicated that they disagreed with the City’s position and further, the County is “supreme” over the City. They boldly, declared the County was not subject to any City laws or regulations. After careful review with our legal counsel, Mayor Dawson then sent a letter to the Commissioners citing the legal precedents that clearly indicates the County is in fact subject to the City Codes aimed at public safety. In this letter, he indicated that if they still disagreed and refused to follow City building codes the City would ask the courts for clarification on the matter. Since the Commissioners did not respond, the City Attorney filed on the City’s behalf a petition asking a judge to settle the dispute by declaring officially what the law says.

In response to the notice of the filing, Presiding Commissioner Taylor told Mayor Dawson that if the City did not cancel the request for clarification by the court he would permanently withhold the City’s portion of road and bridge taxes. Mr. Taylor made additional threats to cancel all contracts with the City, to include the 911 dispatch, emergency management, and collection of property taxes. He stated that he already canceled the quarterly road tax payment due in April to Sedalia and that Council needs to decide how important the building codes were to them. Mr. Taylor indicated he would not recognize a judge’s ruling and instead, use the withheld road tax funds to hire lawyers to fight the City. At this point, the City was left with a very tough decision, either take legal action to ensure the safety of citizens or surrender to Mr. Taylor’s threats. The decision that needed to be made was clear, move forward to ensure citizens were safe through the administration of building codes and inspections to include fire department preplanning. City of Sedalia 200 S. Osage Sedalia, MO 65301 (660) 827-3000 www.cityofsedalia.com.

During the process of requesting a judge to provide clarification to settle the dispute, more has been learned about the steps the Commissioners have taken. Pettis County Treasurer, in compliance with their fiduciary duty, issued a check to Sedalia in April, as it was stated during the ballot measure. Further requiring the Treasurer to transfer the tax funds, was a duly adopted budget, so one Commissioner was without authority to withhold such payment. Nevertheless, one Commissioner intercepted the check and hid it in a drawer by his own sworn admission. Three months later, on July 7, 2023, when the next quarterly payment was due, the full Commission passed a resolution that basically states the Commission will withhold payments to any city that is involved with any legal action with the County. Recently an “application” process was issued by the Commission with an effective date of January 1, 2024. In conjunction with developing the application, the Commission evidently rescinded their resolution from July 7, 2023 without notification to the City. However, Sedalia has not received any of the past road tax payments and to date the total withheld is $365,400. The previous statements and actions, leave reason to believe that Sedalia will not be fairly considered during the road tax “application” process where these same Commissioners that have made these statements and taken the actions to withhold funds are making the decision for “approval."

The underlying resistance to working together to ensure public safety is unfortunate considering one of a government’s first responsibilities is to ensure the safety of their community. A recent private company sprinkler inspection showed several deficiencies or dangers that remain uncorrected in a county building. To be fair, this shows promise that they are taking steps to repair safety items such as sprinkler systems. This inspection relates to a City petition referencing the lack of safety protocols in County buildings. About the time the attorneys for the County were trying to come up with an answer to the City's petition, the Commissioners were scrambling to have inspections and repairs to the fire safety systems in at least the jail, specifically the sprinkler systems and fire alarms. It is not clear from the report what safety items were fixed, but the report indicates several items remain not functioning as of the January report date.

After receiving a summary judgement order ruling that the County was in fact subject to City public safety codes, the County then hired another attorney to continue to fight the court process. The City learned that the same day the County engaged a new attorney was the same day (October 20, 2023) the fire equipment service items were inspected by their private vendor. The new attorney filed a motion with more delay tactics, in keeping with the Commissioners’ previous statements they will use the road tax dollars intended to fix roads to pay lawyers instead of allowing their buildings to have safety inspections.

Past statements were document in the newspaper published November 24, 2023 with a headline of moving the County seat. These bold statements from two of the three Commissioners were in reaction to the City’s notice of structural engineer inspections. The inspections are to assist building owners in determining if their aging buildings remain safe for the public, employees, visitors, and public safety individuals responding to emergencies. If the buildings had issues, wouldn’t they want to know this? Due to past tragedies, Sedalia took a proactive approach after individuals died in building collapses in Clinton and sadly even here in Sedalia. In 1986, two individuals were killed and two were injured when a building collapsed in Sedalia. Then in 2006, a building collapsed in Clinton killing one individual and nine others had to be dug out of the rubble with various states of injury. In 2009 through 2011, three more buildings collapsed in downtown Sedalia, luckily no one was injured during this series of collapses.

In 2013, to prevent further deaths, injuries, and dangers from building collapses, City officials created a program to provide structural engineer inspections to each building downtown. The inspections are free of charge to the owner and provide expertise to help owners address structural issues, maintain the integrity of downtown Sedalia, and keep our citizens safe. The inspections are conducted every ten years, hence the reason the Commissioners, as well as every other downtown building owner, received a notice the City will provide structural engineering to complete the ten-year update in 2024. Instead of working together to ensure the buildings, such as the courthouse, are maintained for future generations the Commission responded with a threat to move the county seat, at what would be substantial tax payer’s expense.

Sedalia offered to waive all fees, but the Commissioners said they still would not comply, likewise, as stated in the letters they referred to, there is no cost to County for downtown structural engineer inspections. Further, in the case of the 911 Emergency Dispatch, Sedalia is by far the largest financial contributor to this contract at $300,000 per year, and in the case of the EMA contract, Sedalia is providing just under $30,000 per year in funding to the county-wide effort, so it is obviously not about “double taxation” as they were quoted in the article.

It is also not all about the Equitable Building, as they purport and were quoted in the article. It is about working together to ensure public safety, including the Equitable Building yes, but not solely. Likewise, Sedalia officials certainly understand the public’s desires, yet also the challenges, of historic preservation of the downtown buildings, which is in part the reasoning for the demolition permitting process. The City simply desires to work together to ensure public safety in all buildings within the City.

Presiding Commissioner Taylor was quoted in the article about downtown building inspections, stating they had the Pettis County Fire District inspect their building. During the court proceedings about this issue, evidence provided to the judge shows specifically that employees of the county have been ordered that “the Pettis County Commission does not want any fire department or City officials to inspect any of the County properties and would not allow it.” This was in response to an attempt by fire officials to review the jail. While it is good that they are at least taking some steps to ensure some sense of public safety, this falls way short of the mark. The Pettis County Fire District, is a “District” that covers only part of the County and this District does not include any part of Sedalia. Therefore, Sedalia Fire will be dispatched to fires at any County building in the City.

Since the County Commissioners have overtly denied access to the department that has to respond to the fire, they have not been able to prepare a fire preplan. Therefore, if a fire happens in a building that is designed to trap individuals inside, including employees, the professionals that are coming to rescue them have no idea where they are at and how to get to them. This would be hard enough in good circumstances, but imagine that when the building is full of smoke. Now overlay that on top of the earlier stated facts about the problems with the sprinkler systems and alarms.

The Commissioner’s inexplicable acts have served to create unnecessary dangers for their employees, as well as, those firefighters that are coming to rescue them. Why do the Commissioners refuse to coordinate with Sedalia Fire to ensure the safety of all individuals that sleep, eat, work, or visit county buildings? It should be noted that the City is confident that this stance is purely coming from the Commissioners and not the other County elected officials and employees. For example, the Sedalia Police Department has a great working relationship with Sheriff Anders.

Through that relationship they have and will continue to work on joint operations to stamp out criminal activity that often straddles the jurisdictional boundary of the City. We are confident that the Sheriff and his jail employees would welcome the help to ensure their safety, and it is only the Commissioners standing in that way. The Commissioners also threatened to cancel all contracts with Sedalia if the request for the declaratory judgement was not dropped. Per the bold statement, this included the 911 Joint Dispatch, Emergency Management, and the collection of property taxes.

The County Commission has threatened to take drastic steps to not only inconvenience the Citizens they were elected to serve, but also, to intentionally put individuals lives at stake by recreating delays in 911 Emergency Dispatch. Further, to use this and emergency management planning as nothing less than extortion to facilitate their continuance of turning a blind eye to keeping citizens lives in danger in other ways, was unimaginable until they actually did it.

To violate the voters’ intent and betraying the promises they made to entice them to vote to approve it, in withholding these tax dollars is bad enough, but this is a while different level of irresponsibility. Quite simply, this is why the City continues to avail itself of the court system. Yes, it would have been much simpler, cost-effective, and politically expedient to give into the bullying tactics, but it is no exaggeration that people’s lives are at stake here and Sedalia’s Mayor and Council couldn’t turn a blind eye to that. The “Pettis County Local Municipality Infrastructure Improvement Grant Application” itself remains inconsistent and appears to be disorganized due to multiple changes in deadlines and requirements. The latest version added some requirements and deemed some expenditures as disallowed and extended the deadline to March 1st.

As stated earlier, serious concerns remain that any application from Sedalia will not be given fair consideration due to the direct statements and actions of the Commissioners. In the summary judgement ruled upon on October 12, 2023 included an order by the judge that says “the Court specifically enjoins Defendants from withholding pending tax payments to the Plaintiff or terminating existing contracts with Plaintiff in retaliation for this litigation or this judgement…” Instead of complying with the judge’s ruling, this process to maneuver around clear voter intent and the judge’s ruling has been created by the Commission. Included in the information submitted on the County’s forms are the following statements. It remains the City of Sedalia’s position that the voter intent is clearly and consistently defined in the education materials provided for the original ballot measure, as well as the extensions of the sunsets requiring voter approval every five years.

One example includes an article published in the Sedalia Democrat right before the latest election providing several quotes of each of the County Commissioners, as well as, former Presiding Commissioner Todd Smith serving as “chairman of the committee supporting passage of the extension.” Here is a portion of that article: Former state Rep. Todd Smith, who serves as chairman of the committee supporting passage of the extension, was the Pettis County Presiding Commissioner when the measure was first passed. “I think Pettis County is at a critical juncture, we can continue growing and take advantage of our recent successes, or we can start backsliding and struggle in the future,” Smith said via email. “With this unique revenue sharing program, in which not only does Pettis County benefit, but every community in Pettis County benefits as well."

While some of the revenue collected by Pettis County is used for county projects, a portion is split among the county’s municipalities. The City of Sedalia is projected to receive $365,400 and the City of Smithton will receive an estimated $79,800. “The City of Smithton alone has used these funds to replace 232 water meters, perform maintenance on storm and drainage systems, purchased updated equipment, and asphalted their major streets,” Baeza said. Estimated revenue projections for other municipalities, according to Marcum, include $26,100 to Hughesville, $42,450 to Houstonia, $149,000 to La Monte, and $67,800 to Green Ridge.

Also, of note, is when reviewing the history of this tax was an article in 2000 where the Presiding Commissioner was quoted indicating that if the tax was passed, high on the list of projects it would fund is the extension of Winchester Road to 32nd Street. The article continues on and states “With approval, Sedalia will receive $365,000 each year to better city streets."

Further evidence of voter intent is implied by the fact that consistently roughly half of the citizens and registered voters of Pettis County reside in the City of Sedalia and those numbers are even greater for those that live just on the outskirts of the city limits. Likewise, the vast majority of the economic activity generating this tax from within Sedalia city limits. Therefore, one could argue that the vast majority of the roads used by those voting for and paying the tax are in Sedalia. Thereby a significant portion of the funds should be made available for these streets.

The City of Sedalia, respectfully requests that the Pettis County Commissioners honor what was told to the voters to encourage them to vote for this tax and the promises made by the Commissioners to such voters if the tax was authorized by them. Therefore, Sedalia requests the funds withheld in 2023 of $365,400 to fund projects in the City’s current fiscal year ending March 31, 2024 budget which includes over $5.5M of transportation spending that was budgeted and expended based on in part the receipt of this funding. Further, Sedalia requests at least another $365,400 to fund projects in calendar year 2024 (Pettis County’s fiscal year).

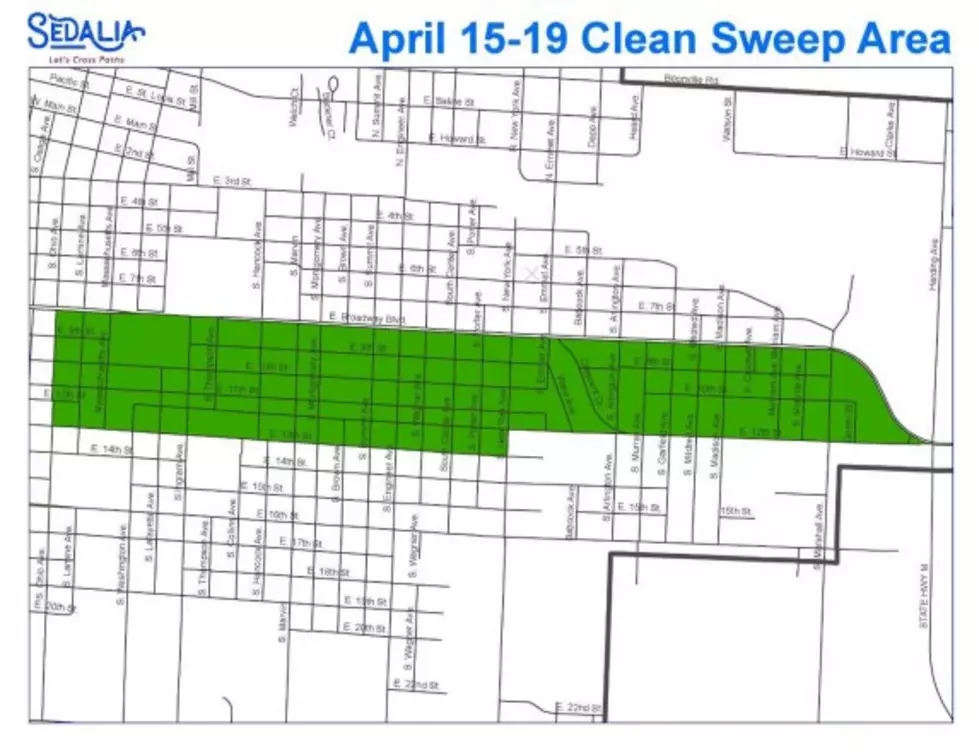

These funds will be again used to augment the other funds Sedalia allocates to transportation projects such as the following: Street Department Maintenance Crews, Materials, & Equipment $4,100,000 Materials for Paving Projects Identified $2,550,000 The number of projects that will be able to be funded will be directly dependent upon the level of funding allocated from these funds. It is anticipated that if a like amount that has been historically allocated of $365,400, then the total funded projects will be a like amount of the current fiscal year of $5.5M. If the Commissioners would like to see specific projects identified and budget details, that is certainly available. In summary, Sedalia requests at least $730,800 to offset approximately 6.6% of the total spending on street projects within Sedalia within Pettis County in calendar year 2024. Since the County Commission has revised their application and added requirements, this additional information is added. The new added requirements indicate, employee salaries and benefits and new “capitol” improvement projects are not allowable. Not being sure what constitutes “new capitol improvement projects” and assuming you meant “capital,” we will add clarity.

Materials only for the following resurfacing projects are as follows: Non Personnel Street Department Expenditures 1,691,252.00 Grand - 20th to 24th 130,000.00 Grand - Main to 65 Hwy 290,000.00 Kentucky - 16th to 20th 95,000.00 Egineer - Reine to Tower 140,000.00 Ingram - 16th to South City Limits 270,000.00 Emmett - Broadway to Tower 240,000.00 Adams / ProEnergy Drive - Cherry Tree to Eagleview 205,000.00 Reine - Cedar to Engineer 55,000.00 24th - Ingram to New York 275,000.00 Park - 32nd to South City Limits 85,000.00 Sedalia Rd & Georgetown Rd Intersection 15,000.00 Total Road Resurfacting Projects 3,491,252.00

Anticipated Contracted Materials & Labor for Sidewalk Repairs are as follows: In total from just these line items that clearly meet the stated requirements: 4,526,252.00 These are just a subset of the most needed areas identified and less than half of them will be able to be funded without any assistance. Again, not being sure what constitutes new capital improvements and why that was determined to be ineligible particularly since the original promise made to the voters was to extend Winchester South, we list the following projects that we have identified to improve transportation in and around Sedalia, benefiting Pettis County residents.

Sidewalk Repair / Replacement Funding Level 500,000.00 Sidewalk State Fair Blvd - 50 Hwy - 3rd - 65 Hwy 310,000.00 Sidewalk 65 Hwy - 7th to Liberty Park Blvd 225,000.00 Total Sidewalk Repair Projects 1,035,000.00 65 Hwy & Sacagawea Traffic Light 400,000.00 32nd & Limit Lane Additions / Improvements Cost Share 750,000.00 65 Hwy & Sacagawea Traffic Light 400,000.00 N. Harding & Booneville Hwy 50 to Airport 1,000,000.00 Pro-Energy to Oak Grove 2,500,000.00 16th & Winchester To Sacajawea 4,000,000.00 Total Traffic Improvement Projects 9,050,000.00

RANKED: These are the richest race car drivers

Gallery Credit: Madison Troyer

More From AM 1050 KSIS